Designing Theory-Informed Behavior Change Apps

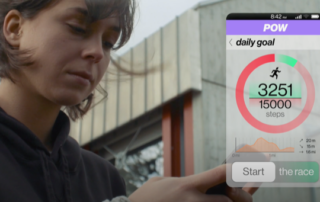

Technology has become a relevant asset for scientists supporting people in modifying their behavior. For instance, we find various apps on the market trying to achieve this. Some inspire their designs in psychological theories, but most do not. Creating theory-based app designs provides a guide on which people's behavioral outcomes to expect in response to a particular stimulus, leading to more robust design and effective apps. How to begin designing theory-informed apps? Continue reading to find out!