Pricing Strategy: How Our Brains Keep Us Stuck

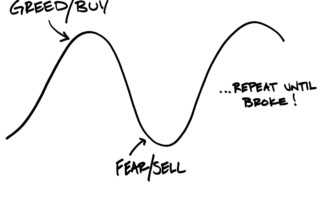

Pricing strategy is a funny area of business that everyone seems to hate. What role does the brain play in this, and how can you leverage behavioral economics to overcome your brain’s natural tendencies?