By Cai Xing

Remembering that I’ll be dead soon is the most important tool I’ve ever encountered to help me make the big choices in life… Remembering that you are going to die is the best way I know to avoid the trap of thinking you have something to lose. — Steve Jobs

The ending effect refers to the phenomenon that the perceived approach of an ending can lead to behavioral changes. In the domain of risky decision-making, individuals show increased risk taking toward the end of a task.

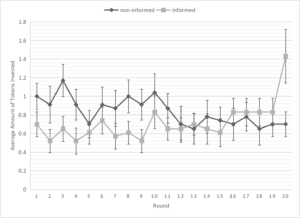

Past studies examining horse races showed that betting on longshots becomes more popular at the end of a racing day. Here, longshots refer to horses that are relatively unlikely to win but pay a large amount if they do. This phenomenon was originally known as “the last race effect”. This effect was also found by several laboratory experiments on other types of risk-taking tasks. More recently, we were able to replicate this finding in our own research (Experiment 1) published in the Personality and Social Psychology Bulletin: compared with participants who were not aware of the endings, those who knew they were working on the last round showed significantly increased risk taking, as depicted in the figure below.

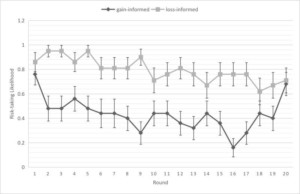

A previous study by McKenzie and colleagues showed that the underlying mechanism of the ending effect is “reference independent”: regardless of previous wins or losses before the last round, individuals consistently show increased risk taking at the end of a series of gambles. What factors, other than previous wins or losses, could account for the ending effect? Our study indicates that the ending effect might be caused by a motivational shift toward emotional satisfaction induced by the perception of an ending. When the options to choose from in the risky task provided the possibility of a gain, the ending effect consistently appeared; in contrast, when no option in the risky task provided the possibility of a loss, the ending effect disappeared. (Note that, before the last round, the possibility of a loss led to consistently higher risk taking, as predicted by prospect theory.)

In the third experiment, we measured individuals’ motivation toward emotional satisfaction (emotional motivation) and toward monetary gain (utilitarian motivation), both during the entire decision session and immediately before the last round. It was found that, as predicted by socioemotional selectivity theory (SST), individuals’ motivation toward emotional satisfaction indeed increased immediately before the last round. More importantly, this increase in emotional motivation predicted greater risk taking in the last round. In contrast, individuals’ motivation toward monetary gains decreased immediately before the last round. However, no predictive power of utilitarian motivation was found for the ending effect. It appears that increased emotional motivation, but not decreased utilitarian motivation was driving the ending effect.

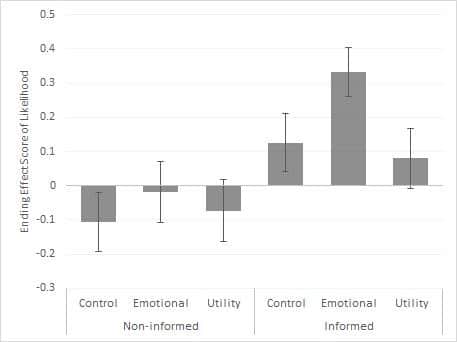

In the fourth experiment, individuals were randomly assigned to one of the six experimental conditions. Half of them were aware of how many decision trials they were going to work on, and the other half were not aware of this until they finished the decision session. Within each of the two condition, individuals were either asked to maximize their monetary gain or to maximize their emotional satisfaction (and there was a control group). It was found that the emotional motivation priming led to significant increase in risk taking in the last round of a set of risky decision task.

Our desire for an emotionally rewarding ending may affect decision-making in many domains of life. Individuals facing terminal illnesses might show different preference for their treatment plans and financial allocation plans, to meet their need for an emotionally satisfying end-of-life experience. Couples who are expecting their first baby might change spending and saving habits, because they have a much longer future to prepare for financially. Individuals who are expecting to retire soon may embrace financial plans that are different from individuals who just started their first job. Therefore, exploring how the time perception of an ending might influence individuals’ economic behaviors have important real-life implications across a wide range of domains.