By C. Monica Capra

Every year, millions of people invest money in projects they may not fully understand and, by choosing to do so, they reveal one of the most important values that holds our society and our economy together: trust.

Trust in advisors, CEOs, and employees. Trust in markets. Trust in the law and in government. Indeed, trust is so important, that it lessens the need for written contracts, encourages innovation, helps preserve property rights, and facilitates exchanges. Yet, trust is so intertwined in our everyday lives that it is often unacknowledged. It is only when trust erodes, that we can appreciate its significance.

Because of trust’s importance in keeping societies and economies together, social scientists have spent considerable amount of time and effort trying to identify the determinants of trust. But, what is trust exactly? And, how can we measure it?

While scholars agree on trust’s myriad benefits, there is less consensus about the exact definition across multiple disciplines. Most experimental economists, like me, have adopted James S. Coleman’s definition found in Foundations of Social Theory, because it provides a measurable description of trust. Based on this definition, trust is seen as an action that involves the voluntary placement of resources at the disposal of a trustee, with no enforceable commitment from the trustee. It is implied that, if one is willing to put oneself in such a vulnerable position, it must be because one has confidence in others.

To measure trust, social scientists use two basic tools: 1) Attitudinal questions and 2) Interactive games. Attitudinal questions such as: “Generally speaking, would you say that most people can be trusted?” provide a measure of the confidence one has in others. Individuals who answer in the affirmative are labeled as trusting. The General Social Survey has been tracking responses to this question since the 1970s. In contrast to attitudinal questions, interactive games elicit trusting actions. These games have the basic feature of allowing a player (investor) to voluntarily transfer money that grows when transferred to an anonymous player (trustee). The trustee, in turn, has the option of transferring back some of or all the money to the investor. Depending on the specific type of trust game, trust is measured by whether money is transferred (Guth, et al., 1997) , or by the amount transferred (Berg et al., 1995). Interestingly, in my own research on trust measures (Capra, et al., 2016), I have found that attitudinal questions are generally good predictors of trusting behaviors.

Since the introduction of trust experiments as measurement tools, there have been a plethora of papers on the topic. To nobody’s surprise, the main determinant of trust is trustworthiness. Clearly, most of us rely on another’s reputation to assess their trustworthiness. For example, before investing in a real estate venture in South America, I extensively researched the project and the management team in charge of the project. But what would happen if it were difficult or impossible to assess trustworthiness? That is, what determines trust in the absence of reputation?

To answer this question, many researchers have studied the effects of observable factors such as nationality, culture, race, age, and sex. Data show that sex, religion, and ethnicity influence trust. Women, religious people, and ethnically homogeneous groups are more trusting (see Johnson and Mislin, 2011 for a meta-analysis). In addition, researchers have found that social distance is an important determinant of pro-social preferences. The shorter the social distance or the closer either psychologically or physiologically one is to another, the higher the chance of observing trusting attitudes and behaviors. Indeed, it is believed that trust is mediated by oxytocin, a hormone that is a neuropeptide and plays a key role in social attachment and affiliation in mammals. Research by Kosfeld, et al. (2005) and others has shown that oxytocin increases the willingness of people to incur or take “social risks”, thus causing an increase in trust.

Although in laboratory conditions, lowering the social distance may generate more willingness to take social risks and trust others, in real life, there are also perils from closeness.

Although in laboratory conditions, lowering the social distance may generate more willingness to take social risks and trust others, in real life, there are also perils from closeness.

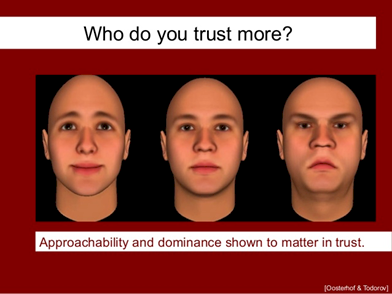

Researchers have found that sometimes social closeness can generate fear and distrust. For example, Alexander Todorov has published several studies on people’s reactions to a range of artificially generated faces. Here is an example of the faces shown in Oosterhof and Todorov’s study. These researchers and colleagues have found that faces with high inner eyebrows, pronounced cheekbones, and a wide chin struck people as trustworthy. Conversely, faces with low inner brows, shallow cheekbones and a thin chin were deemed untrustworthy – public access to computer generated trustworthy faces can be found here.

In addition, voice can also influence our perception of trustworthiness. On hearing a novel voice, listeners readily form personality impressions of the speaker and, regardless of accuracy, these impressions affect how listeners subsequently interact with the person whose voice they heard. People can easily classify voices as trustworthy or untrustworthy. Researchers have found that male voices perceived as more trustworthy have lower pitch. In contrast, female voices perceived as more trustworthy tended to lower at the end of a word (McAleer, et al., 2014).

What do we know about trust? Economic agents rarely enjoy the benefit of complete information when engaging in transactions. Indeed, each agent in an exchange must rely on her confidence in the other party’s ability and willingness to honor a commitment. For example, financial advisors need to earn the trust of investors. Social science research tells us that financial advisors should not only care about reputation, but should be cognizant that other factors, such as social closeness, like-mindedness, facial features, and even voice play a role in influencing investors’ trust.