By Ariel Cecchi

Planning for retirement is an endeavor that we all need to undertake sooner or later. A well thought-out pension plan must be able to ensure our well-being during a long period of professional inactivity.

However, a striking finding is that people do not save enough for their retirement. They have difficulty designing a retirement plan tailored to their needs and end up with an insufficient pension income and an impoverished lifestyle.

Behavioral economics has pointed out some of the problems that affect retirement planning.

European Pension Schemes

Pension schemes in Europe differ largely from one country to another. However, a three-pillar scheme classification illustrates how Europeans deal with retirement. Such a scheme includes a public pillar, an occupational (public/private) pillar, and a voluntary individual one [2].

The first pillar is designed to avoid poverty in old age. Regardless of the pension contribution of the future pensioner, the state provides all citizens with a minimum pension income. Its purpose is to ensure a basic standard of living for all retired individuals.

The occupational pillar covers employment-related pension plans. Pensions depend on periodic contributions from the employee’s income. It ensures the adequacy between current salary and future pension.

There are two modalities. In the defined benefit (DB) pensions the benefits are calculated based on the proportion of earnings and years of contribution, rather than on the amount contributed. If the worker retires before the stipulated age, they will be penalized and their pension reduced. Defined contribution (DC) pensions, by contrast, determine the benefits as a proportion of the amount contributed, rather than on the number of years. Roughly, contributions are registered to a saving account which is paid out upon retirement. [2]

The third pillar gives people the opportunity to make additional voluntary savings. This is a pension plan that most depends on the motivation and planning of the individual.

Demographic change and financial risk

The first pillar and DB pensions are based on a redistributive scheme [2]. The benefit received by a pensioner is irrespective of the contribution this person has paid for their pension. In such a redistributive scheme, current employees pay for the pension income of retirees and expect that the next generation of workers will pay for them too [3].

The subsistence of the system depends on the ratio between the number of workers paying their contributions and the number of pensioners receiving income benefits. If the number of workers is lower than the number of pensioners, the system becomes unstable and unpopular measures need to be taken. Either the workers’ pension contribution is raised or the pensioners’ income is reduced [3].

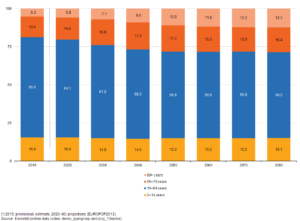

The demographic change in Europe, caused by an increasing life expectancy and falling birth rates, has a serious impact on redistributive schemes. The life expectancy between 2005 and 2014 has increased more than 2 years [4]; it is about 16 years after retirement (65 years). Further life expectancy gains are projected for the next decades (see table). Considered alongside declining fertility rates, this means that the number of pensioners will drastically increase, while the number of workers will considerably decrease.

Today, pensioners represent 18.9% of the population compared to 65.5% of the workforce. This means that there is a little bit more than 10 working-age people for every 3 retired people. However, according to the EU projections, the proportion of pensioners by 2040 will be 26.9%, while workers will only represent 58.5%. That is, the ratio between workers and pensioners will be 10 to 5. [5] If you are in your early forties, your retirement will be effective in 25 years, around 2040. By this time, there will be only two workers ensuring your pension income. This proportion will be smaller twenty years after your retirement, by 2060.

These projections show that European governments will certainly struggle to ensure the pension income for every citizen without adopting effective reforms.

Another problem faced by the European pension system, such as DC pensions and the third pillars, is financial risk.

These schemes depend on funded pensions in which the return obtained is determined by the amount contributed and the benefits received. Inadequate planning can cause a contributor to end up with a lower pension than expected. This might happen because of market instability or the individual’s inexperience in managing their retirement portfolio [1, 2].

European Reforms

To mitigate the impact of the population ageing and the financial risk on pension schemes, the European Commission has been recommending several changes in EU countries’ pension systems. These recommendations include increasing statutory pension ages, promoting gender equality, limiting early retirement, increasing the integration and employability of young and older workers, encouraging saving, and more.

Thanks to these recommendations, the EU’s public pension spendings in 2060 (as a percentage of GDP) is expected to be similar to today’s level [5].

However, pension reforms are not always adopted optimally. More significant and effective changes need to be designed to preserve pensioners’ standard of living in Europe [2].

A complete reform of pension schemes capable of benefiting all citizens requires efforts on the part of both governments and the population. Based on this logic, retirement becomes an individual concern: it is not only the role of the State to ensure the welfare of citizens during their retirement, but also the duty of individuals to look after their future [3, 6].

Emotions, Immediacy, and Complexity

If our pension income ensures living conditions in old age, why do people struggle to save enough for their retirement? Behavioral economics provides us with some insights.

An important factor related to retirement decision making concerns the emotional burden involved. We do not like to think about old age, a period of life frequently associated with illness, loneliness, decline in consumption, loss of social status, and the like [3, 7].

Moreover, between the age of 25 and 45, our energy is focused on more immediate tasks or projects, such as finishing studies, work and career, forming a family, buying a property, and the like. It is only after our forties that we begin to think seriously about our retirement. At that point, it may be too late to significantly improve our future pension income . [3, 7]

Complexity is another key factor that affects our retirement decisions. Pension plans are sometimes difficult to understand and dealing with them involves time and effort. Planning requires an anticipation of our lifestyle, income calculations, the forecasting of financial risk, and other variables. People’s lack of knowledge in some of these domains can make retirement planning an arduous endeavor. Problems with our pension estimates can lead to a poor standard of living [1].

Procrastination, Temporal Discounting, and Financial Literacy

The emotional burden, current projects, and the complexity involved in retirement planning can have a negative impact on our lives as pensioners.

Complexity and the emotional burden lead us to procrastinate. Procrastination is a psychological state that makes us desist from carrying out tasks or making decisions by systematically postponing deadlines. To make matters worse, the greater the task or the decision, the more we tend to procrastinate. And when we have no alternative left but to tackle the problem, it is frequently too late to solve it adequately.

Although people realize that postponing retirement-related decisions may carry future costs (to their pension income), the immediate cost to be incurred in terms of time and effort encourages individuals to avoid the planning [1].

The temporal distance of retirement and more immediate tasks lead us to what is known as temporal discounting [3, 7]. This psychological vulnerability refers to our tendency to prefer immediate rewards to rewards more distant in time. Temporal discounting is explained by the fact that individuals attribute more value to a reward obtained immediately than to a greater reward obtained later. Current pleasures prevail over future benefits. For example, a consumer will usually prefer £500 now to £520 in a month’s time. Waiting a month for £20 more is not perceived as a sufficient trade-off. The satisfaction derived from the immediate reward is then overweighted.

People’s preference for immediate rewards declines and eventually reverses as the time horizon lengthens [7]. The further a reward lies in the future, the less value is attributed to it. If the person is offered £500 in six months or £520 in seven months, they will surely choose the second option.

People would rather have some money to spend now (in restaurants, the movies, long-weekend holidays, etc.) than defer consumption in favor of a better pension income (a reward obtained in twenty- or thirty-year time!). The tendency to prefer a modest reward now rather than expecting a more significant return in the future can be disastrous for saving toward retirement and ensure our future well-being [1, 7].

Temporal discounting and procrastination are intimately related to financial literacy. This concept refers to the subjects’ knowledge on financial matters and their capacity to make effective decisions about investing, retirement, and other financial domains.

When it comes to retirement planning, evidence shows that a great number of future pensioners do not appear to understand pension fund systems, asset allocation, and risk tolerance [1, 2]. For instance, people are too optimistic with regard to pension income projections. Either because their estimate of the pension income is too high or because they underestimate the expenditures and lifestyle after retirement (higher health care costs, greater life expectancy, etc.) [3]. Similarly, people’s inexperience in managing a portfolio frequently causes the tendency to trade too much or to under-diversify portfolios. For the same reason, people fail to balance their risk profile tolerance as retirement draws closer and consequently incur losses [1].

Not surprisingly, knowledge about pensions increases as retirement approaches. The growing interest in pension issues helps individuals to become more knowledgeable [1]. Nonetheless, it might already be too late at that point to make substantial changes to their pension scheme to ensure an adequate income.

We all have a role to play

Behavioral scientists and economists work together with governments to solve the problems affecting the EU pension systems and help citizens to save more for retirement. Nevertheless, more time and effort is needed to design better and more robust strategies. Most importantly, individuals also have a central role to play. Unfortunately, in order to plan for retirement and secure their lifestyle as pensioners, people are faced with complex information and decisions, and they have to deal with situations that are not particularly enjoyable and provide no short-term rewards. A growing body of work in behavioral economics (such as this one) now focuses on ways in which an understanding of human psychology can help people save more for their retirement.

[1] Ackert, L. and Deaves, R. (2010) : Behavioral Finance. Psychology, Decision-Making, and Markets, Cengage Learning, ch. 17.

[2] “Pension Schemes” (2014), Directorate General For Internal Policies, Policy Department A: Economic and Scientific Policy.

[3] Raaij, W. F. van. (2015) : Understanding Consumer Financial Behavior: Money Management in an Age of Financial Illiteracy, Palgrave Macmillan, ch. 6.

[4] “Life expectancy by age and sex”, Population (Demography, Migration and Projections), Eurostat.

[5] “The 2015 Ageing Report. Economic and Budgetary Projections for the 28 EU Member States (2013-2060)”, Economic Policy Committee (EPC), European Commission.

[6] “The 2015 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in the EU”, Volume I, Social Protection Committee (SPC) and European Commission (DG EMPL).

[7] Howard, J. A. and Yazdipour, R. (2014): “Retirement Planning: Contributions from the Field of Behavioral Finance and Economics”, in H. K. Baker and V. Ricciardi (Eds.), Investor Behavior: The Psychology of Financial Planning and Investing, Wiley, ch. 16.